Earnings Per Share: Basic - Lesson 2

In the video 16.01 - Earnings Per Share - Basic - Lesson 2, Roger Philipp, CPA, CGMA, explains the components of the basic Earnings Per Share (EPS) calculation. The numerator for Basic EPS is net income minus preferred dividends, depending on whether the preferred dividends are cumulative or non-cumulative, declared or not declared.

If preferred dividends are non-cumulative, include only those declared. If cumulative, include the accumulated dividend for the year regardless of whether it was declared. The denominator for Basic EPS is the weighted average number of common stock shares outstanding.

Stock issuance, treasury stock repurchase, stock dividends, stock subscriptions, and stock splits must be accounted for when determining the weighted average. Of these, only shares issued to the public during the year and treasury stock repurchases are prorated for the portion of the year to which they apply. All others are applied retrospectively when calculating basic EPS; they are calculated as if they occurred the first day of the year.

Website: https://accounting.uworld.com/cpa-review/

Blog: https://accounting.uworld.com/blog/cpa-review/

Twitter: https://twitter.com/UWorldRogerCPA

Facebook: https://www.facebook.com/UWorldRogerCPAReview

Instagram: https://www.instagram.com/uworldrogercpareview/

Pinterest: https://www.pinterest.com/uworldrogercpareview/

LinkedIn: https://www.linkedin.com/company/uworld-roger-cpa-review

Are you accounting faculty looking for FREE CPA Exam resources in the classroom? Visit our Professor Resource Center: https://accounting.uworld.com/cpa-review/partner/university/

Video Transcript Sneak Peek:

Now, as we go through this, what we need to do is we need to kinda set it up so that it's understandable. So, what I'm gonna do is I'm gonna set up here the two types called basic and diluted. And as you calculate it, it's what? It's something divided by something to get your earnings per share.

So as we look at this, I'm gonna start here with my basic earnings per share, which is simple. And that is your basic or your simple earnings per share. That assumes there's nothing potentially dilutive. Then, we're gonna go on to our diluted earnings per share, which is your complex system, which is anyone who could convert, does so. So, we're gonna go through this and we're gonna calculate it. We're gonna have this divided by something. So, up here we're gonna have the dollars and we're gonna divide it by a certain number of shares.

Видео Earnings Per Share: Basic - Lesson 2 канала UWorld Roger CPA Review

If preferred dividends are non-cumulative, include only those declared. If cumulative, include the accumulated dividend for the year regardless of whether it was declared. The denominator for Basic EPS is the weighted average number of common stock shares outstanding.

Stock issuance, treasury stock repurchase, stock dividends, stock subscriptions, and stock splits must be accounted for when determining the weighted average. Of these, only shares issued to the public during the year and treasury stock repurchases are prorated for the portion of the year to which they apply. All others are applied retrospectively when calculating basic EPS; they are calculated as if they occurred the first day of the year.

Website: https://accounting.uworld.com/cpa-review/

Blog: https://accounting.uworld.com/blog/cpa-review/

Twitter: https://twitter.com/UWorldRogerCPA

Facebook: https://www.facebook.com/UWorldRogerCPAReview

Instagram: https://www.instagram.com/uworldrogercpareview/

Pinterest: https://www.pinterest.com/uworldrogercpareview/

LinkedIn: https://www.linkedin.com/company/uworld-roger-cpa-review

Are you accounting faculty looking for FREE CPA Exam resources in the classroom? Visit our Professor Resource Center: https://accounting.uworld.com/cpa-review/partner/university/

Video Transcript Sneak Peek:

Now, as we go through this, what we need to do is we need to kinda set it up so that it's understandable. So, what I'm gonna do is I'm gonna set up here the two types called basic and diluted. And as you calculate it, it's what? It's something divided by something to get your earnings per share.

So as we look at this, I'm gonna start here with my basic earnings per share, which is simple. And that is your basic or your simple earnings per share. That assumes there's nothing potentially dilutive. Then, we're gonna go on to our diluted earnings per share, which is your complex system, which is anyone who could convert, does so. So, we're gonna go through this and we're gonna calculate it. We're gonna have this divided by something. So, up here we're gonna have the dollars and we're gonna divide it by a certain number of shares.

Видео Earnings Per Share: Basic - Lesson 2 канала UWorld Roger CPA Review

Показать

Комментарии отсутствуют

Информация о видео

Другие видео канала

Earnings Per Share: Basic - Lesson 3

Earnings Per Share: Basic - Lesson 3 P/E Ratio Basics

P/E Ratio Basics

What does 'earnings per share' mean? - MoneyWeek Investment Tutorials

What does 'earnings per share' mean? - MoneyWeek Investment Tutorials![Is The CPA Exam Worth It? [2021 Salary, Statistics & Case Studies]](https://i.ytimg.com/vi/j87TPZ92ZYc/default.jpg) Is The CPA Exam Worth It? [2021 Salary, Statistics & Case Studies]

Is The CPA Exam Worth It? [2021 Salary, Statistics & Case Studies] Earnings Per Share: Diluted - Lesson 1

Earnings Per Share: Diluted - Lesson 1 Earnings Per Share Explained | Phil Town

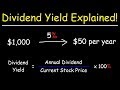

Earnings Per Share Explained | Phil Town The Dividend Yield - Basic Overview

The Dividend Yield - Basic Overview Earnings Per Share: Basic - Lesson 1

Earnings Per Share: Basic - Lesson 1 Basic Earnings per Share

Basic Earnings per Share PE RATIO EXPLAINED - HOW TO USE PRICE EARNINGS RATIO FOR STOCK MARKET DECISIONS

PE RATIO EXPLAINED - HOW TO USE PRICE EARNINGS RATIO FOR STOCK MARKET DECISIONS Earnings Per Share: Treasury Stock Method

Earnings Per Share: Treasury Stock Method Dividend Basics with the Robinhood App

Dividend Basics with the Robinhood App Earnings per share (EPS), basic and diluted

Earnings per share (EPS), basic and diluted FAR Exam Earnings Per Share

FAR Exam Earnings Per Share How to Stay Motivated to Study for the CPA Exam

How to Stay Motivated to Study for the CPA Exam How is the Stock Price Determined? | Stock Market for Beginners (Part 1) | Lumovest

How is the Stock Price Determined? | Stock Market for Beginners (Part 1) | Lumovest Price to Earnings (P/E) Ratio and Earnings Per Share (EPS) Explained

Price to Earnings (P/E) Ratio and Earnings Per Share (EPS) Explained Analytical Procedures: Basic Comparison Types

Analytical Procedures: Basic Comparison Types Price earnings ratio explained

Price earnings ratio explained