Section 965: Income Inclusion and Deduction for 10% Shareholders

The 2017 tax law requires 10% or more shareholders of foreign corporations to include in their income their share of the earnings and profits of the foreign corporation, generally in 2017. In this video, you will learn:

Time Topic

00:00 Introduction & overview

01:17 Deadline March 15 or April 15

01:32 To whom it applies

02:18 Inclusion required

03:13 Deduction: 55% or 77%

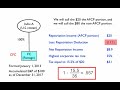

04:00 Example (simplified, but with some detail)

06:19 Election to pay in installments (8% in 2017)

07:08 Future repatriation tax free

07:42 Special rules for S corporations

08:28 To Do list (checklist)

10:13 Wrap up

Resources:

Text of new law as presented for signature (not yet in US Code): https://www.congress.gov/115/bills/hr1/BILLS-115hr1enr.pdf

There are no exercises for this topic.

For more information: contact Stephen C. Fox, CPA, sfoxcpa.com

Видео Section 965: Income Inclusion and Deduction for 10% Shareholders канала International Tax

Time Topic

00:00 Introduction & overview

01:17 Deadline March 15 or April 15

01:32 To whom it applies

02:18 Inclusion required

03:13 Deduction: 55% or 77%

04:00 Example (simplified, but with some detail)

06:19 Election to pay in installments (8% in 2017)

07:08 Future repatriation tax free

07:42 Special rules for S corporations

08:28 To Do list (checklist)

10:13 Wrap up

Resources:

Text of new law as presented for signature (not yet in US Code): https://www.congress.gov/115/bills/hr1/BILLS-115hr1enr.pdf

There are no exercises for this topic.

For more information: contact Stephen C. Fox, CPA, sfoxcpa.com

Видео Section 965: Income Inclusion and Deduction for 10% Shareholders канала International Tax

Показать

Комментарии отсутствуют

Информация о видео

Другие видео канала

Tax Cuts and Jobs Act of 2017: International Tax Reform

Tax Cuts and Jobs Act of 2017: International Tax Reform Subpart F: Section 956

Subpart F: Section 956 Section 965 Deemed Repatriation from Foreign Corporations

Section 965 Deemed Repatriation from Foreign Corporations Subpart F part 2: Pro Rata Share, and Foreign Personal Holding Company Income

Subpart F part 2: Pro Rata Share, and Foreign Personal Holding Company Income Pass-Through Considerations of Tax Reform

Pass-Through Considerations of Tax Reform Overview of Foreign Tax Credit: Revised for 2017 Law Changes

Overview of Foreign Tax Credit: Revised for 2017 Law Changes The IRSMedic 2020 Form 5471 Guide Part 1: Overview - What is IRS Form 5471?

The IRSMedic 2020 Form 5471 Guide Part 1: Overview - What is IRS Form 5471? Controlled Foreign Corporation | Subchapter F Income | International C{PA Exam

Controlled Foreign Corporation | Subchapter F Income | International C{PA Exam Demystifying American Taxes

Demystifying American Taxes Tax Treaties, part 2

Tax Treaties, part 2 Discussion: U.S. Tax Reform: Global Implications for Investment and Corporate Financing

Discussion: U.S. Tax Reform: Global Implications for Investment and Corporate Financing Increasing Your Income

Increasing Your Income International Tax Reform Part 2 - GILTI, FDII & BEAT

International Tax Reform Part 2 - GILTI, FDII & BEAT Business Interest Expense Limitation | Corporate Income Tax Course | TCJA 217 | CPA Exam Regulation

Business Interest Expense Limitation | Corporate Income Tax Course | TCJA 217 | CPA Exam Regulation OECD Tax Talks #9 - Centre for Tax Policy and Administration

OECD Tax Talks #9 - Centre for Tax Policy and Administration Downward Attribution and Filing of Form 5471

Downward Attribution and Filing of Form 5471 Tax Reform: S Corp Vs. C Corp: Who Saves More?

Tax Reform: S Corp Vs. C Corp: Who Saves More? Form 2555, Foreign Earned Income Exclusion

Form 2555, Foreign Earned Income Exclusion Pay No US Taxes - Foreign Owned LLCs

Pay No US Taxes - Foreign Owned LLCs TAX7705 Webinar: Check the Box, International Corporate Events, PFICs

TAX7705 Webinar: Check the Box, International Corporate Events, PFICs