Webinar - GreenTraderTax - How To Be Eligible For Substantial Tax Savings As A Trader

Join Robert A. Green, CPA, of GreenTraderTax.com as he explains the tax advantages of “trader tax status” (TTS).

· Learn the golden rules in detail for how to be eligible for and claim TTS, no election is required.

·Automated trading systems (ATS) can qualify for TTS, providing the trader is significantly involved with the ATS. Trade copying software might not be eligible.

·TTS traders deduct business expenses, startup costs, and home office expenses, whereas investors cannot.

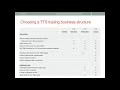

·Learn how TTS traders use an S-Corp to deduct health insurance and retirement plan contributions.

·TTS traders are entitled to elect Section 475 MTM ordinary gain or loss treatment. Section 475 trades are exempt from wash sale losses on securities, and the $3,000 capital loss limitation.

· Section 475 income, net of TTS expenses, is eligible for the 20% qualified business income (QBI) deduction if the trader is under the taxable income threshold.GreenTraderTax - How To Be Eligible For Substantial Tax Savings As A Trader

Registration: https://attendee.gotowebinar.com/register/4256245103818193163

Видео Webinar - GreenTraderTax - How To Be Eligible For Substantial Tax Savings As A Trader канала Interactive Brokers

· Learn the golden rules in detail for how to be eligible for and claim TTS, no election is required.

·Automated trading systems (ATS) can qualify for TTS, providing the trader is significantly involved with the ATS. Trade copying software might not be eligible.

·TTS traders deduct business expenses, startup costs, and home office expenses, whereas investors cannot.

·Learn how TTS traders use an S-Corp to deduct health insurance and retirement plan contributions.

·TTS traders are entitled to elect Section 475 MTM ordinary gain or loss treatment. Section 475 trades are exempt from wash sale losses on securities, and the $3,000 capital loss limitation.

· Section 475 income, net of TTS expenses, is eligible for the 20% qualified business income (QBI) deduction if the trader is under the taxable income threshold.GreenTraderTax - How To Be Eligible For Substantial Tax Savings As A Trader

Registration: https://attendee.gotowebinar.com/register/4256245103818193163

Видео Webinar - GreenTraderTax - How To Be Eligible For Substantial Tax Savings As A Trader канала Interactive Brokers

Показать

Комментарии отсутствуют

Информация о видео

Другие видео канала

Webinar - GreenTraderTax - How To Set Up A Trading Business For Optimal Tax Savings

Webinar - GreenTraderTax - How To Set Up A Trading Business For Optimal Tax Savings Option and Stock Markets See Something Differently

Option and Stock Markets See Something Differently Must...Buy...Dips...

Must...Buy...Dips... Adieu August, Hello Again Apple and Tesla

Adieu August, Hello Again Apple and Tesla U.S. Corporate Bond Market - Intro to the IBKR Global Bond Scanner

U.S. Corporate Bond Market - Intro to the IBKR Global Bond Scanner How to value a company using net assets - MoneyWeek Investment Tutorials

How to value a company using net assets - MoneyWeek Investment Tutorials GreenTraderTax - Webinar - How To Structure A Trading Business For Significant Tax Savings

GreenTraderTax - Webinar - How To Structure A Trading Business For Significant Tax Savings Wait, They Go Down Too?

Wait, They Go Down Too? 🔴 How to Value a Company in 3 Easy Steps - Valuing a Business Valuation Methods Capital Budgeting

🔴 How to Value a Company in 3 Easy Steps - Valuing a Business Valuation Methods Capital Budgeting How to invest in a stocks and shares isa - MoneyWeek Videos

How to invest in a stocks and shares isa - MoneyWeek Videos Eric Trump on Growing Up in the TRUMP Family: Family, Loyalty, Business - Eric Trump & Kiyosaki

Eric Trump on Growing Up in the TRUMP Family: Family, Loyalty, Business - Eric Trump & Kiyosaki GreenTraderTax - How To Set Up A Trading Business In 2018

GreenTraderTax - How To Set Up A Trading Business In 2018 BEST FOREX BROKERS 2020 | TOP 8 HOTTEST 🔥 FOREX BROKERS REVIEW! 😱

BEST FOREX BROKERS 2020 | TOP 8 HOTTEST 🔥 FOREX BROKERS REVIEW! 😱 Upgrade Monday - Tesla, Barrick, Nvidia, SPX

Upgrade Monday - Tesla, Barrick, Nvidia, SPX How To Sell Your Home Without A Capital Gain Tax

How To Sell Your Home Without A Capital Gain Tax INCOME TAX MCQ | UGC NET Commerce | MCQ Series 2020 | Part-30 | NTA NET JRF Commerce

INCOME TAX MCQ | UGC NET Commerce | MCQ Series 2020 | Part-30 | NTA NET JRF Commerce How to value a company using discounted cash flow (DCF) - MoneyWeek Investment Tutorials

How to value a company using discounted cash flow (DCF) - MoneyWeek Investment Tutorials Software Asset Management | Overview

Software Asset Management | Overview Adding Multiple TWS Chart Windows

Adding Multiple TWS Chart Windows