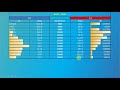

Bid and Ask Quantity: Intraday trader can now tell which stocks institutions are buying and selling

💎Bid and Ask Quantity interpretation - Total Buying volume and Selling Volume

This video explains the use of bid and ask quantity in finding the market direction. This is very useful method for day traders to find the market direction. The total buying and selling volume available in order book can reveal the institution/fund house trades. This video explains the basics of order book, market depth, institution way of placing orders and how to find the active buy / sell trades.

The trading volume is simply made of executed buy and sell order. But the total pending buy order and sell order can also be use by intraday traders to access the market sentiment.

The buy order which are placed at ask price or above is considered as active buy order. It also indicates the aggressive nature of buyer.

The sell order which are placed at bid price or below is considered as active sell order. It also indicates the aggressive nature of seller

The participation of aggressive buyers and sellers makes the market to move up and down. Hence, this way of interpreting the order book can help you in judging the market direction.

#TOTALBID #TOTALASK #EQSIS

Relevant Links

EQSIS Website: https://www.eqsis.com/

Ask New Video: https://www.eqsis.com/ask-eqsis/

EQSIS YouTube Channel: https://www.youtube.com/user/eqsis/videos

More Details on BID and Ask Volume: https://www.thebalance.com/buying-and-selling-volume-1031027

Видео Bid and Ask Quantity: Intraday trader can now tell which stocks institutions are buying and selling канала EQSIS

This video explains the use of bid and ask quantity in finding the market direction. This is very useful method for day traders to find the market direction. The total buying and selling volume available in order book can reveal the institution/fund house trades. This video explains the basics of order book, market depth, institution way of placing orders and how to find the active buy / sell trades.

The trading volume is simply made of executed buy and sell order. But the total pending buy order and sell order can also be use by intraday traders to access the market sentiment.

The buy order which are placed at ask price or above is considered as active buy order. It also indicates the aggressive nature of buyer.

The sell order which are placed at bid price or below is considered as active sell order. It also indicates the aggressive nature of seller

The participation of aggressive buyers and sellers makes the market to move up and down. Hence, this way of interpreting the order book can help you in judging the market direction.

#TOTALBID #TOTALASK #EQSIS

Relevant Links

EQSIS Website: https://www.eqsis.com/

Ask New Video: https://www.eqsis.com/ask-eqsis/

EQSIS YouTube Channel: https://www.youtube.com/user/eqsis/videos

More Details on BID and Ask Volume: https://www.thebalance.com/buying-and-selling-volume-1031027

Видео Bid and Ask Quantity: Intraday trader can now tell which stocks institutions are buying and selling канала EQSIS

Показать

Комментарии отсутствуют

Информация о видео

Другие видео канала

How Markets REALLY Work - Depth of Market (DOM)

How Markets REALLY Work - Depth of Market (DOM) Option Premium Calculation Simplified. Try this shortcut trick to find delta - EQSIS

Option Premium Calculation Simplified. Try this shortcut trick to find delta - EQSIS What Does The Bid & Ask Mean? (Investing In The Stock Market)

What Does The Bid & Ask Mean? (Investing In The Stock Market) 💰 Forget NSE Option chain, Try this smart way to analyse Open interest

💰 Forget NSE Option chain, Try this smart way to analyse Open interest 💰 Option Buyers Can Make Money: How?

💰 Option Buyers Can Make Money: How?![This must be the smartest way to find the NSE open interest - [Bubble Chart Technique]](https://i.ytimg.com/vi/vDHdMkpB8lg/default.jpg) This must be the smartest way to find the NSE open interest - [Bubble Chart Technique]

This must be the smartest way to find the NSE open interest - [Bubble Chart Technique] Bid vs Ask Prices: How Buying and Selling Work ☝️

Bid vs Ask Prices: How Buying and Selling Work ☝️

How to read a DOM (Depth of Market) with example trade

How to read a DOM (Depth of Market) with example trade Supertrend + RSI Strategy | Easiest Intraday/Scalping strategy for beginners | CA Akshatha Udupa

Supertrend + RSI Strategy | Easiest Intraday/Scalping strategy for beginners | CA Akshatha Udupa Order flow basics - What is the DOM? Why is it useful? What do the numbers mean?

Order flow basics - What is the DOM? Why is it useful? What do the numbers mean? 😎 FII Open Interest Analysis – Part 2: Tricks to find what FII trades using open interest

😎 FII Open Interest Analysis – Part 2: Tricks to find what FII trades using open interest What Is The Basic Difference Between Bid, Ask and Spreads?

What Is The Basic Difference Between Bid, Ask and Spreads? The Best Ever Intraday Tool for Day Trading

The Best Ever Intraday Tool for Day Trading FREE weekly report - how to see what institutions are buying and selling in the stock market.

FREE weekly report - how to see what institutions are buying and selling in the stock market. How to pick stock for intraday trading

How to pick stock for intraday trading चार्ट छोड़ो प्राइस पकड़ो # Price Action Intraday Strategy # Trading Without Chart # Secrets Strategy

चार्ट छोड़ो प्राइस पकड़ो # Price Action Intraday Strategy # Trading Without Chart # Secrets Strategy Simple Guide to predict Market Trend by Option Chain I Derivatives I Options

Simple Guide to predict Market Trend by Option Chain I Derivatives I Options![⌛ Option Chain Analysis Explained Using Filters and Charts [With Live Examples] - EQSIS](https://i.ytimg.com/vi/ApBzucw-mTs/default.jpg) ⌛ Option Chain Analysis Explained Using Filters and Charts [With Live Examples] - EQSIS

⌛ Option Chain Analysis Explained Using Filters and Charts [With Live Examples] - EQSIS Bid-Ask Spread Explained | Options Trading

Bid-Ask Spread Explained | Options Trading