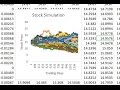

Simple Monte Carlo Simulation of Stock Prices with Python

In this tutorial, we will go over Monte Carlo simulations and how to apply them to generate randomized future prices within Python.

My Website: http://programmingforfinance.com/

Code:

#------------------------------------------------------------------------------------#

import pandas_datareader.data as web

import pandas as pd

import datetime as dt

import numpy as np

import matplotlib.pyplot as plt

from matplotlib import style

style.use('ggplot')

start = dt.datetime(2017, 01, 03)

end = dt.datetime(2017, 11, 20)

prices = web.DataReader('AAPL', 'google', start, end)['Close']

returns = prices.pct_change()

last_price = prices[-1]

#Number of Simulations

num_simulations = 1000

num_days = 252

simulation_df = pd.DataFrame()

for x in range(num_simulations):

count = 0

daily_vol = returns.std()

price_series = []

price = last_price * (1 + np.random.normal(0, daily_vol))

price_series.append(price)

for y in range(num_days):

if count == 251:

break

price = price_series[count] * (1 + np.random.normal(0, daily_vol))

price_series.append(price)

count += 1

simulation_df[x] = price_series

fig = plt.figure()

fig.suptitle('Monte Carlo Simulation: AAPL')

plt.plot(simulation_df)

plt.axhline(y = last_price, color = 'r', linestyle = '-')

plt.xlabel('Day')

plt.ylabel('Price')

plt.show()

#------------------------------------------------------------------------------------#

Видео Simple Monte Carlo Simulation of Stock Prices with Python канала codebliss

My Website: http://programmingforfinance.com/

Code:

#------------------------------------------------------------------------------------#

import pandas_datareader.data as web

import pandas as pd

import datetime as dt

import numpy as np

import matplotlib.pyplot as plt

from matplotlib import style

style.use('ggplot')

start = dt.datetime(2017, 01, 03)

end = dt.datetime(2017, 11, 20)

prices = web.DataReader('AAPL', 'google', start, end)['Close']

returns = prices.pct_change()

last_price = prices[-1]

#Number of Simulations

num_simulations = 1000

num_days = 252

simulation_df = pd.DataFrame()

for x in range(num_simulations):

count = 0

daily_vol = returns.std()

price_series = []

price = last_price * (1 + np.random.normal(0, daily_vol))

price_series.append(price)

for y in range(num_days):

if count == 251:

break

price = price_series[count] * (1 + np.random.normal(0, daily_vol))

price_series.append(price)

count += 1

simulation_df[x] = price_series

fig = plt.figure()

fig.suptitle('Monte Carlo Simulation: AAPL')

plt.plot(simulation_df)

plt.axhline(y = last_price, color = 'r', linestyle = '-')

plt.xlabel('Day')

plt.ylabel('Price')

plt.show()

#------------------------------------------------------------------------------------#

Видео Simple Monte Carlo Simulation of Stock Prices with Python канала codebliss

Показать

Комментарии отсутствуют

Информация о видео

Другие видео канала

WEBCAST: Introduction to Risk and Decision Analysis using @RISK

WEBCAST: Introduction to Risk and Decision Analysis using @RISK 6. Monte Carlo Simulation

6. Monte Carlo Simulation Monte Carlo Simulation of a Stock Portfolio with Python

Monte Carlo Simulation of a Stock Portfolio with Python Monte Carlo Simulation

Monte Carlo Simulation Monte Carlo Integration In Python For Noobs

Monte Carlo Integration In Python For Noobs Stock Price Prediction Using Python & Machine Learning

Stock Price Prediction Using Python & Machine Learning Monte Carlo Simulation of Stock Price Movement

Monte Carlo Simulation of Stock Price Movement How to Simulate Stock Price Changes with Excel (Monte Carlo)

How to Simulate Stock Price Changes with Excel (Monte Carlo) A Random Walk & Monte Carlo Simulation || Python Tutorial || Learn Python Programming

A Random Walk & Monte Carlo Simulation || Python Tutorial || Learn Python Programming![MONTE Carlo Simulation of Value at Risk (VaR) in Python [Brownian Motion]🔴](https://i.ytimg.com/vi/11YDPyTGMnc/default.jpg) MONTE Carlo Simulation of Value at Risk (VaR) in Python [Brownian Motion]🔴

MONTE Carlo Simulation of Value at Risk (VaR) in Python [Brownian Motion]🔴 Monte Carlo Prediction

Monte Carlo Prediction Predicting Stock Prices in Python

Predicting Stock Prices in Python Monte Carlo Simulation with Python | 2.5h Full Course | Part 4/8 | Python for Finance

Monte Carlo Simulation with Python | 2.5h Full Course | Part 4/8 | Python for Finance What is the Monte Carlo method? | Monte Carlo Simulation in Finance | Pricing Options

What is the Monte Carlo method? | Monte Carlo Simulation in Finance | Pricing Options Monte Carlo Simulation with Card Games

Monte Carlo Simulation with Card Games R Beginner Monte Carlo Simulation

R Beginner Monte Carlo Simulation What is a Monte Carlo Simulation?

What is a Monte Carlo Simulation? The Monte Carlo Method

The Monte Carlo Method EXCEL- Simulation of stock prices

EXCEL- Simulation of stock prices Building A Probabilistic Risk Estimate Using Monte Carlo Simulations

Building A Probabilistic Risk Estimate Using Monte Carlo Simulations