What's the Most Tax-Efficient Way to Invest - IRAs, 401ks, Brokerage Accounts?

Now that company pensions have become almost as rare as still-operating video rental stores, we’re all essentially responsible for managing our own retirement plans. But on the good news front, at various times, our representatives in Washington have set up specialized, tax-advantaged accounts designed to encourage us to save. Prominent among them, the Individual Retirement Account, or IRA. You probably know all that already, of course, but what you may not be as aware of -- unless you’re doing particularly well in your career -- is that there’s an income level above which those incentives stop applying.

In this segment of the Motley Fool Answers podcast, host Alison Southwick and her special guests -- Motley Fool senior analyst Jason Moser, and Ross Anderson, a certified financial planner at Motley Fool Wealth Management -- talk about the ways a couple that previously focused on maxing out their IRAs with dividend payers should pivot their strategy in light of their new higher salaries.

------------------------------------------------------------------------

Subscribe to The Motley Fool's YouTube Channel:

http://www.youtube.com/TheMotleyFool

Or, follow our Google+ page:

https://plus.google.com/+MotleyFool/posts

Inside The Motley Fool: Check out our Culture Blog!

http://culture.fool.com

Join our Facebook community:

https://www.facebook.com/themotleyfool

Follow The Motley Fool on Twitter:

https://twitter.com/themotleyfool

Видео What's the Most Tax-Efficient Way to Invest - IRAs, 401ks, Brokerage Accounts? канала The Motley Fool

In this segment of the Motley Fool Answers podcast, host Alison Southwick and her special guests -- Motley Fool senior analyst Jason Moser, and Ross Anderson, a certified financial planner at Motley Fool Wealth Management -- talk about the ways a couple that previously focused on maxing out their IRAs with dividend payers should pivot their strategy in light of their new higher salaries.

------------------------------------------------------------------------

Subscribe to The Motley Fool's YouTube Channel:

http://www.youtube.com/TheMotleyFool

Or, follow our Google+ page:

https://plus.google.com/+MotleyFool/posts

Inside The Motley Fool: Check out our Culture Blog!

http://culture.fool.com

Join our Facebook community:

https://www.facebook.com/themotleyfool

Follow The Motley Fool on Twitter:

https://twitter.com/themotleyfool

Видео What's the Most Tax-Efficient Way to Invest - IRAs, 401ks, Brokerage Accounts? канала The Motley Fool

Показать

Комментарии отсутствуют

Информация о видео

Другие видео канала

Amazon's Next Move | Investor Beat - 11/11/13 | The Motley Fool

Amazon's Next Move | Investor Beat - 11/11/13 | The Motley Fool Banking Stress Tests: Should Big Bank Investors Start Worrying? | Where the Money Is - 11/4/13

Banking Stress Tests: Should Big Bank Investors Start Worrying? | Where the Money Is - 11/4/13 Google, Amazon and Seven More Hit All-Time Highs | Investor Beat - 9/20/13 | The Motley Fool

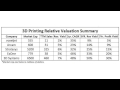

Google, Amazon and Seven More Hit All-Time Highs | Investor Beat - 9/20/13 | The Motley Fool A New Public 3D Printing Company?

A New Public 3D Printing Company? Our Favorite Offshore Drillers and MLPs | Digging for Value - 10/10/13 | The Motley Fool

Our Favorite Offshore Drillers and MLPs | Digging for Value - 10/10/13 | The Motley Fool Inspiration for the Mini Metal Maker | 3-D Printing Hobbyist & Inventor David Hartkop | Part 2 of 14

Inspiration for the Mini Metal Maker | 3-D Printing Hobbyist & Inventor David Hartkop | Part 2 of 14 Stitch Fix Stock is Down Big - Is it a Buy?

Stitch Fix Stock is Down Big - Is it a Buy? Apple Reports Earnings | Investor Beat - 10/29/13 | The Motley Fool

Apple Reports Earnings | Investor Beat - 10/29/13 | The Motley Fool Starbucks | Stock of the Day - 2/11/14 | The Motley Fool

Starbucks | Stock of the Day - 2/11/14 | The Motley Fool Avoid These 8 Common Mistakes and You'll Live a Happier, Healthier Life!

Avoid These 8 Common Mistakes and You'll Live a Happier, Healthier Life! Berkshire Hathaway | Stock of the Day - 3/14/13 | The Motley Fool

Berkshire Hathaway | Stock of the Day - 3/14/13 | The Motley Fool 5 Companies with Huge Pensions Set Up to Fall

5 Companies with Huge Pensions Set Up to Fall Tips for Beginner Investors: Don't Buy IPOs

Tips for Beginner Investors: Don't Buy IPOs Where Is the Best Investment in 3D Printing Companies?

Where Is the Best Investment in 3D Printing Companies? What’s Taking the Ford Turnaround So Long?

What’s Taking the Ford Turnaround So Long? What Would Buffett Do? | Where The Money Is - 8/5/13 | The Motley Fool

What Would Buffett Do? | Where The Money Is - 8/5/13 | The Motley Fool Earnings Season Jitters | Investor Beat - 2/12/14 | The Motley Fool

Earnings Season Jitters | Investor Beat - 2/12/14 | The Motley Fool Investor Beat May 29- Apple vs Google

Investor Beat May 29- Apple vs Google Stocks to Watch in 2014: Twitter, Intel, Bank of Internet, Potash Corporation and Extendicare

Stocks to Watch in 2014: Twitter, Intel, Bank of Internet, Potash Corporation and Extendicare The Best and Worst Big Banks of 2013 | Investor Beat - 12/26/13 | The Motley Fool

The Best and Worst Big Banks of 2013 | Investor Beat - 12/26/13 | The Motley Fool The Government Shutdown Continues, and Potbelly Goes Public | Investor Beat | The Motley Fool

The Government Shutdown Continues, and Potbelly Goes Public | Investor Beat | The Motley Fool