Keynesian Theory of Demand for Money (HINDI)

The demand for money refers to how much assets individuals wish to hold in the form of money. It is also referred as liquidity preference. The demand for money is related to income, interest rates and whether people prefer to hold money.

Keynes suggested three motives which led to the demand for money in an economy:

(1) the transactions demand,

(2) the precautionary demand,

(3) the speculative demand.

The transactions demand for money arises from the medium of exchange function of money

Given these factors, the transactions demand for money is a direct proportional and positive function of the level of income and is expressed as

L1 = kY

Where L1 is the transactions demand for money, k is the proportion of income which is kept for transactions purposes, and Y is the income.

The Precautionary motive relates to “the desire to provide for contingencies requiring sudden expenditures and for unforeseen opportunities of advantageous purchases.” Both individuals and businessmen keep cash in reserve to meet unexpected needs.

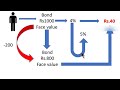

The speculative demand for money is for securing profit from knowing better than the market what the future will bring forth. Individuals and businessmen having funds, after keeping enough for transactions and precautionary purposes, like to make a speculative gain by investing in bonds. Bond prices and the rate of interest are inversely related to each other.

#YOUCANLEARNECONOMICS

#ECONOMICS

Subscribe me @ http://youtube.com/c/EZClassesfaghsa

Like me on Facebook @ https://www.facebook.com/faghsa/

Follow me on Twitter @ https://twitter.com/?lang=en

Mail ID: faghsa1760@gmail.com

Видео Keynesian Theory of Demand for Money (HINDI) канала E.Z. Classes

Keynes suggested three motives which led to the demand for money in an economy:

(1) the transactions demand,

(2) the precautionary demand,

(3) the speculative demand.

The transactions demand for money arises from the medium of exchange function of money

Given these factors, the transactions demand for money is a direct proportional and positive function of the level of income and is expressed as

L1 = kY

Where L1 is the transactions demand for money, k is the proportion of income which is kept for transactions purposes, and Y is the income.

The Precautionary motive relates to “the desire to provide for contingencies requiring sudden expenditures and for unforeseen opportunities of advantageous purchases.” Both individuals and businessmen keep cash in reserve to meet unexpected needs.

The speculative demand for money is for securing profit from knowing better than the market what the future will bring forth. Individuals and businessmen having funds, after keeping enough for transactions and precautionary purposes, like to make a speculative gain by investing in bonds. Bond prices and the rate of interest are inversely related to each other.

#YOUCANLEARNECONOMICS

#ECONOMICS

Subscribe me @ http://youtube.com/c/EZClassesfaghsa

Like me on Facebook @ https://www.facebook.com/faghsa/

Follow me on Twitter @ https://twitter.com/?lang=en

Mail ID: faghsa1760@gmail.com

Видео Keynesian Theory of Demand for Money (HINDI) канала E.Z. Classes

Показать

Комментарии отсутствуют

Информация о видео

Другие видео канала

Milton Friedman's Quantity Theory of Money (HINDI)

Milton Friedman's Quantity Theory of Money (HINDI) Classical to Neo-Classical Economists (HINDI)

Classical to Neo-Classical Economists (HINDI) Liquidity Trap in Hindi

Liquidity Trap in Hindi 3.1 The Concept of Money Demand l Eco Revision | Buy Pen Drive Classes at Conferenza.in

3.1 The Concept of Money Demand l Eco Revision | Buy Pen Drive Classes at Conferenza.in

PART 7(B)- SPECULATIVE MOTIVE AND LIQUIDITY TRAP.

PART 7(B)- SPECULATIVE MOTIVE AND LIQUIDITY TRAP. Keynes theory of Demand for Money

Keynes theory of Demand for Money Diamond Water Paradox (HINDI)

Diamond Water Paradox (HINDI) Keynesian Theory of Income and Employment (HINDI)

Keynesian Theory of Income and Employment (HINDI) Fiscal Policy (HINDI)

Fiscal Policy (HINDI) Tobin's Theory of Demand for Money (HINDI)

Tobin's Theory of Demand for Money (HINDI) Phillips Curve Inflation and Unemployment in Hindi

Phillips Curve Inflation and Unemployment in Hindi Fisher Version of Quantity Theory of Money (HINDI)

Fisher Version of Quantity Theory of Money (HINDI) Investment Multiplier - MPC & MPS (HINDI)

Investment Multiplier - MPC & MPS (HINDI)

Liquidity Preference Theory of Interest

Liquidity Preference Theory of Interest Theories of Inflation || Demand Pull Inflation, Cost Push Inflation, Structure Inflation || |HINDI|

Theories of Inflation || Demand Pull Inflation, Cost Push Inflation, Structure Inflation || |HINDI| Rational Expectation Hypothesis HINDI

Rational Expectation Hypothesis HINDI DEMAND FOR MONEY | FISHER'S APPROACH | TRANSACTION APPROACH | SAHIL ROY

DEMAND FOR MONEY | FISHER'S APPROACH | TRANSACTION APPROACH | SAHIL ROY Monetary Policy (HINDI)

Monetary Policy (HINDI)