Best Price Action Harmonic Trading Patterns Free signal indicator|Harmonic Pattern Trading Strategy

Best Price Action Harmonic Trading Patterns Free signal indicator|Harmonic Pattern Trading Strategy

\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\

download indicator

https://forexpasha.blogspot.com/2019/09/best-harmonic-pattern-indicator-free.html

Types of Harmonic Patterns

There is quite an assortment of harmonic patterns, although there are four that seem most popular. These are the Gartley, butterfly, bat, and crab patterns.

The Gartley

The Gartley was originally published by H.M. Gartley in his book Profits in the Stock Market and the Fibonacci levels were later added by Scott Carney in his book The Harmonic Trader. The levels discussed below are from that book. Over the years, some other traders have come up with some other common ratios. When relevant, those are mentioned as well.

bullish and bearish gartley pattern

The bullish pattern is often seen early in a trend, and it is a sign the corrective waves are ending and an upward move will ensue following point D. All patterns may be within the context of a broader trend or range and traders must be aware of that. (For related insight, see "Elliott Wave Theory").

It's a lot of information to absorb, but this is how to read the chart. We will use the bullish example. The price moves up to A, it then corrects and B is a 0.618 retracement of wave A. The price moves up via BC and is a 0.382 to 0.886 retracement of AB. The next move is down via CD, and it is an extension of 1.13 to 1.618 of AB. Point D is a 0.786 retracement of XA. Many traders look for CD to extend 1.27 to 1.618 of AB.

The area at D is known as the potential reversal zone. This is where long positions could be entered, although waiting for some confirmation of the price starting to rise is encouraged. A stop-loss is placed not far below entry, although addition stop loss tactics are discussed in a later section.

For the bearish pattern, look to short trade near D, with a stop loss not far above.

The Butterfly

The butterfly pattern is different than the Gartley in that the butterfly has point D extending beyond point X.

bullish and bearish butterfly pattern

Here we will look at the bearish example to break down the numbers. The price is dropping to A. The up wave of AB is a 0.786 retracement of XA. BC is a 0.382 to 0.886 retracement of AB. CD is a 1.618 to 2.24 extension of AB. D is at a 1.27 extension of the XA wave. D is an area to consider a short trade, although waiting for some confirmation of the price starting to move lower is encouraged. Place a stop loss not far above.

With all these patterns, some traders look for any ratio between the numbers mentioned, while others look for one or the other. For example, above it was mentioned that CD is a 1.618 to 2.24 extension of AB. Some traders will only look for 1.618 or 2.24, and disregard numbers in between unless they are very close to these specific numbers.

The Bat

The bat pattern is similar to Gartley in appearance, but not in measurement.

bullish and bearish bat pattern

Let's look at the bullish example. There is a rise via XA. B retraces 0.382 to 0.5 of XA. BC retraces 0.382 to 0.886 of AB. CD is a 1.618 to 2.618 extension of AB. D is at a 0.886 retracement of XA. D is the area to look for a long, although the wait for the price to start rising before doing so. A stop loss can be placed not far below.

\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\

Welcome Friends to 's Biggest Technical Analysis Youtube Channel

Our Dream is to make you an Expert in Trading any Market, be it Indian Stocks, Commodity or Forex Trading. We plan to achieve that by:

* By providing you A-Z of Technical Analysis and Fundamental Analysis training,

* By Giving you tools, Strategies and Indicators to know the markets better,

* By Providing you a Demo trading platform free of cost to test the waters

* By Providing you a Mobile App, to Monitor, Study, Analyze and trade on the Go.

* By Providing you Free Honest Product reviews related to Trading.

Our Channel has Videos basic videos from what is Technical Analysis to advanced concepts like Trading Divergences, we have training videos in Trading Psychology, Money Management along with hardcore Technical Analysis videos.

Wishing you all the very best.

.....................................................

forex trading strategies

best forex trading platform

forex trading for beginners

forex trading tutorial

what is forex trading and how does it work

forex trading reviews

forex market live

a

Видео Best Price Action Harmonic Trading Patterns Free signal indicator|Harmonic Pattern Trading Strategy канала Forex Pasha

\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\

download indicator

https://forexpasha.blogspot.com/2019/09/best-harmonic-pattern-indicator-free.html

Types of Harmonic Patterns

There is quite an assortment of harmonic patterns, although there are four that seem most popular. These are the Gartley, butterfly, bat, and crab patterns.

The Gartley

The Gartley was originally published by H.M. Gartley in his book Profits in the Stock Market and the Fibonacci levels were later added by Scott Carney in his book The Harmonic Trader. The levels discussed below are from that book. Over the years, some other traders have come up with some other common ratios. When relevant, those are mentioned as well.

bullish and bearish gartley pattern

The bullish pattern is often seen early in a trend, and it is a sign the corrective waves are ending and an upward move will ensue following point D. All patterns may be within the context of a broader trend or range and traders must be aware of that. (For related insight, see "Elliott Wave Theory").

It's a lot of information to absorb, but this is how to read the chart. We will use the bullish example. The price moves up to A, it then corrects and B is a 0.618 retracement of wave A. The price moves up via BC and is a 0.382 to 0.886 retracement of AB. The next move is down via CD, and it is an extension of 1.13 to 1.618 of AB. Point D is a 0.786 retracement of XA. Many traders look for CD to extend 1.27 to 1.618 of AB.

The area at D is known as the potential reversal zone. This is where long positions could be entered, although waiting for some confirmation of the price starting to rise is encouraged. A stop-loss is placed not far below entry, although addition stop loss tactics are discussed in a later section.

For the bearish pattern, look to short trade near D, with a stop loss not far above.

The Butterfly

The butterfly pattern is different than the Gartley in that the butterfly has point D extending beyond point X.

bullish and bearish butterfly pattern

Here we will look at the bearish example to break down the numbers. The price is dropping to A. The up wave of AB is a 0.786 retracement of XA. BC is a 0.382 to 0.886 retracement of AB. CD is a 1.618 to 2.24 extension of AB. D is at a 1.27 extension of the XA wave. D is an area to consider a short trade, although waiting for some confirmation of the price starting to move lower is encouraged. Place a stop loss not far above.

With all these patterns, some traders look for any ratio between the numbers mentioned, while others look for one or the other. For example, above it was mentioned that CD is a 1.618 to 2.24 extension of AB. Some traders will only look for 1.618 or 2.24, and disregard numbers in between unless they are very close to these specific numbers.

The Bat

The bat pattern is similar to Gartley in appearance, but not in measurement.

bullish and bearish bat pattern

Let's look at the bullish example. There is a rise via XA. B retraces 0.382 to 0.5 of XA. BC retraces 0.382 to 0.886 of AB. CD is a 1.618 to 2.618 extension of AB. D is at a 0.886 retracement of XA. D is the area to look for a long, although the wait for the price to start rising before doing so. A stop loss can be placed not far below.

\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\

Welcome Friends to 's Biggest Technical Analysis Youtube Channel

Our Dream is to make you an Expert in Trading any Market, be it Indian Stocks, Commodity or Forex Trading. We plan to achieve that by:

* By providing you A-Z of Technical Analysis and Fundamental Analysis training,

* By Giving you tools, Strategies and Indicators to know the markets better,

* By Providing you a Demo trading platform free of cost to test the waters

* By Providing you a Mobile App, to Monitor, Study, Analyze and trade on the Go.

* By Providing you Free Honest Product reviews related to Trading.

Our Channel has Videos basic videos from what is Technical Analysis to advanced concepts like Trading Divergences, we have training videos in Trading Psychology, Money Management along with hardcore Technical Analysis videos.

Wishing you all the very best.

.....................................................

forex trading strategies

best forex trading platform

forex trading for beginners

forex trading tutorial

what is forex trading and how does it work

forex trading reviews

forex market live

a

Видео Best Price Action Harmonic Trading Patterns Free signal indicator|Harmonic Pattern Trading Strategy канала Forex Pasha

Показать

Комментарии отсутствуют

Информация о видео

Другие видео канала

how to use forex trading bullish engulfing pattern easy tutorial

how to use forex trading bullish engulfing pattern easy tutorial How to Make a Forex Trading Plan » Learn To Trade The Market

How to Make a Forex Trading Plan » Learn To Trade The Market Best Forex strategy for consistent profits||Forex intraday scalping trading strategies for beginners

Best Forex strategy for consistent profits||Forex intraday scalping trading strategies for beginners Learn Forex Trading "CPI" in Forex Trading|How to Trade Commodity Channel Index (CCI) in Forex

Learn Forex Trading "CPI" in Forex Trading|How to Trade Commodity Channel Index (CCI) in Forex How to Trade the inverse head and shoulders pattern bearish for beginners

How to Trade the inverse head and shoulders pattern bearish for beginners How to Trade Forex Using Elliott Waves|elliott wave forex trading strategy|elliott wave forecast

How to Trade Forex Using Elliott Waves|elliott wave forex trading strategy|elliott wave forecast How to different Forex Trading |Technical Analysis and fundamental Anallysis |very easy to explained

How to different Forex Trading |Technical Analysis and fundamental Anallysis |very easy to explained Top 3 rules|online forex trading|the stock markets|professional forex traders|very easy explained

Top 3 rules|online forex trading|the stock markets|professional forex traders|very easy explained What is a bullish symmetrical triangle?

What is a bullish symmetrical triangle? How to Day Trade with the Stochastic RSI Indicator|| Best Forex Trading Strategies secret in 2022

How to Day Trade with the Stochastic RSI Indicator|| Best Forex Trading Strategies secret in 2022 3 Hidden Secrets of the Moving Average - Trading Strategy Guides|moving average crossover Strategies

3 Hidden Secrets of the Moving Average - Trading Strategy Guides|moving average crossover Strategies Learning To Trade Bearish ‘Butterfly’ Harmonic Pattern|Best Harmonic Forex Trading Strategies

Learning To Trade Bearish ‘Butterfly’ Harmonic Pattern|Best Harmonic Forex Trading Strategies Traditional Desert Village Life|Cholistan Desert | Mud House |Qila Mauj Garh|400 Years Old

Traditional Desert Village Life|Cholistan Desert | Mud House |Qila Mauj Garh|400 Years Old Forex Trading Psychology - Manage your emotions while trading

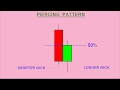

Forex Trading Psychology - Manage your emotions while trading 'Pin Bar' Forex Trading Strategy - Pin Bar Definition » Learn To Trade|PriceAction

'Pin Bar' Forex Trading Strategy - Pin Bar Definition » Learn To Trade|PriceAction how to use forex trading Piercing pattern easy tutorial

how to use forex trading Piercing pattern easy tutorial How to Trade Double Tops in Forex Reversal Patterns Forex Trader's Guide

How to Trade Double Tops in Forex Reversal Patterns Forex Trader's Guide 5 Types of BEST Forex Trading Strategies That Work

5 Types of BEST Forex Trading Strategies That Work inverse head and shoulders pattern|How to Trade the Head and Shoulders Pattern in Forex strategy

inverse head and shoulders pattern|How to Trade the Head and Shoulders Pattern in Forex strategy how to use forex trading Morning star pattern easy tutorial

how to use forex trading Morning star pattern easy tutorial how to use forex trading bearish engulfing pattern easy tutorial

how to use forex trading bearish engulfing pattern easy tutorial