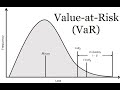

Value at Risk Explained in 5 Minutes

Ryan O'Connell, CFA, FRM explains Value at Risk (VaR) in 5 minutes. He explains how VaR can be calculated using mean and standard deviation. This explanation will be useful for CFA and FRM Candidates. He also explains the following three approaches to calculating Value at Risk (VaR):

0:00 VaR Definition

0:32 VaR Calculation Example

3:00 The Parametric Method (Variance Covariance Method), The Historical Method, and The Monte Carlo Method

Check out Ryan's reading list for finance professionals and investor's here:

1. Liar's Poker by Michael Lewis: https://amzn.to/3ueFii2

2. Freakonomics by Steven D Levitt: https://amzn.to/3vrPt40

3. Against the Gods: A Remarkable Story of Risk by Peter L. Bernstein: https://amzn.to/3fdWUX1

4. Market Wizards by Jack D. Schwager: https://amzn.to/3vg16v2

5. Mastery by Robert Greene: https://amzn.to/3veHDLd

Check out my website for more articles and videos related to finance and investing:

portfolioconstructs.com

For inquiries, please reach out to:

portfolioconstructs@gmail.com

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This YouTube Channel is owned and operated by Portfolio Constructs LLC

*As an Amazon Associate I earn from qualifying purchases.

Видео Value at Risk Explained in 5 Minutes канала Ryan O'Connell, CFA

0:00 VaR Definition

0:32 VaR Calculation Example

3:00 The Parametric Method (Variance Covariance Method), The Historical Method, and The Monte Carlo Method

Check out Ryan's reading list for finance professionals and investor's here:

1. Liar's Poker by Michael Lewis: https://amzn.to/3ueFii2

2. Freakonomics by Steven D Levitt: https://amzn.to/3vrPt40

3. Against the Gods: A Remarkable Story of Risk by Peter L. Bernstein: https://amzn.to/3fdWUX1

4. Market Wizards by Jack D. Schwager: https://amzn.to/3vg16v2

5. Mastery by Robert Greene: https://amzn.to/3veHDLd

Check out my website for more articles and videos related to finance and investing:

portfolioconstructs.com

For inquiries, please reach out to:

portfolioconstructs@gmail.com

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This YouTube Channel is owned and operated by Portfolio Constructs LLC

*As an Amazon Associate I earn from qualifying purchases.

Видео Value at Risk Explained in 5 Minutes канала Ryan O'Connell, CFA

Показать

Комментарии отсутствуют

Информация о видео

Другие видео канала

7. Value At Risk (VAR) Models

7. Value At Risk (VAR) Models Calculating VAR and CVAR in Excel in Under 9 Minutes

Calculating VAR and CVAR in Excel in Under 9 Minutes How to Pass CFA Level 1 Exam

How to Pass CFA Level 1 Exam FRM: Three approaches to value at risk (VaR)

FRM: Three approaches to value at risk (VaR) The surprising habits of original thinkers | Adam Grant

The surprising habits of original thinkers | Adam Grant Value at Risk (VaR) Explained!

Value at Risk (VaR) Explained! Value at Risk or VaR, a tool to master market risk, explained in clear terms with Excel model.

Value at Risk or VaR, a tool to master market risk, explained in clear terms with Excel model. Value at Risk Calculation in Excel - Historical Simulation Method

Value at Risk Calculation in Excel - Historical Simulation Method Understanding Basic concept of Value at Risk (VaR) - Simplified

Understanding Basic concept of Value at Risk (VaR) - Simplified Financial Planning & Analysis Explained In 5 Minutes

Financial Planning & Analysis Explained In 5 Minutes Take a Seat in the Harvard MBA Case Classroom

Take a Seat in the Harvard MBA Case Classroom What is value at risk (VaR)? FRM T1-02

What is value at risk (VaR)? FRM T1-02 Economics Major vs Finance Major

Economics Major vs Finance Major NPV And IRR Explained | BA II Plus

NPV And IRR Explained | BA II Plus The first 20 hours -- how to learn anything | Josh Kaufman | TEDxCSU

The first 20 hours -- how to learn anything | Josh Kaufman | TEDxCSU Monte Carlo Simulation of Value at Risk (VaR) in Excel

Monte Carlo Simulation of Value at Risk (VaR) in Excel What is Value at Risk? VaR and Risk Management

What is Value at Risk? VaR and Risk Management Normal Distribution & Z-scores

Normal Distribution & Z-scores VaR (Value at Risk), explained

VaR (Value at Risk), explained Three approaches to value at risk (VaR) and volatility (FRM T4-1)

Three approaches to value at risk (VaR) and volatility (FRM T4-1)